One of the most impactful and unpredictable variables in logistics costs are Customs examination fees. Customs and other government agencies do not publicly disclose exactly how they determine cargo is flagged for exam, but we’ve been able to gather the following:

- An importer’s track record matters.

- New importers are more susceptible to exams

- If an importer has an extended history of compliance, exam occurrences are less frequent

- A single incident of non-compliance can trigger repeated exams

- Joining C-TPAT helps build a track record

- Certain commodities are more susceptible to exams:

- Dangerous and hazardous goods

- Product involving plant and animal health

- Product that might involve copyright infringement. Many Customs exams result in requesting copies of proper licensing agreements.

- Descriptions manifested on the cargo can trigger exams. Importers are encouraged to give detailed descriptions if the name of the product can be misleading.

- For ocean imports into the United States, 10+2 ISF Filing is required 24 hours prior to a vessel departing the origin port. If this is not filed on time, containers are likely to be flagged for an X-ray exam. This also applies to LCL (shared) containers. IE. If you share a container with other importers, all it takes is one non compliant importer to trigger an X-ray exam.

- Exam costs vary depending on:

- Type of exam – Physical vs. X-ray

- Mode of Transportation – Air occasionally does not result in fees

- Location – Some ports are more expensive than others

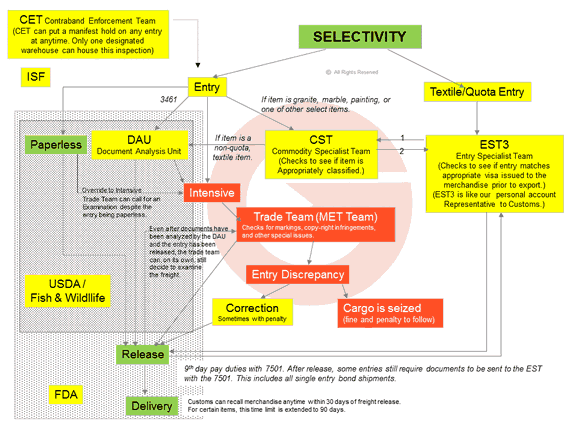

The diagram below shows the complexity of US Customs. Each government organization and/or department examines cargo for different reasons. Thus, shipments can be flagged by multiple government organizations and/or departments for exam.

For importers who routinely import, exams are inevitable. Bottom line is to stay compliant. Cargocentric’s 30+ years as a licensed Customs brokerage can help. Sign up to get started.